AI Is Everywhere—But Is It in Your Portfolio?

Many investors are eager to capitalize on the ongoing boom in artificial intelligence (AI). Some believe owning market leaders like NVIDIA is essential, while others prefer broader exposure through AI-themed funds. However, what many may not realize is that their portfolios likely already have significant exposure to the AI trend. In this blog, we’ll explore how AI’s reach extends beyond the familiar tech giants, almost touching every company and industry today.

AI Giants

By now, most investors have heard of the headline-making American technology company NVIDIA and its visionary CEO, Jensen Huang. Investor sentiment around NVIDIA began to change in 2016 as the company started to become known as a “pick-and-shovel play” on AI. Since then, NVIDIA has delivered a staggering 22,000% total return—including more than 1,000% since the release of ChatGPT in November 2022. NVIDIA’s stellar performance has led many investors to explore other stocks and AI-themed funds in hopes of capturing similar outsized gains.

The size of today’s tech giants is difficult to overstate. In July, NVIDIA became the first company in history to reach a $4 trillion market valuation, with Microsoft becoming the second just days later. The top five stocks in the S&P 500, by market cap, now make up nearly 29% of the index, and the top ten account for nearly 40%—each with meaningful investments in and exposure to AI. According to FactSet, more than 200 S&P 500 companies cited AI on their earnings calls in the first quarter. All of this excitement can make it tempting to seek out the next big winner in AI, but it’s important to recognize that investors can achieve meaningful exposure to the AI theme while still maintaining a well-diversified portfolio. Blue Trust solutions’ exposure to key AI players is detailed at the end of this article.

AI Business Impact

For both individuals and businesses, the great hope for AI is that it will boost productivity. As corporations continue to invest heavily in the AI buildout, investors will be looking for evidence that AI-driven productivity is showing up in company results. For example, Meta Platforms’ recent earnings report showed that margins expanded, and earnings beat expectations as advertising revenue exceeded expectations. CEO Mark Zuckerberg credited the strong results to AI “unlocking greater efficiency and gains across the ad system.” Similarly, Amazon reported that AI has improved customer experiences, boosted coders’ productivity, and increased the efficiency of its one million robots and inventory management systems by 10% and 20%, respectively.

AI exposure is not limited to the flashiest technology companies. The healthcare industry is using it to accelerate drug discovery and improve preventive screening for diseases like cancer by enabling earlier, more accurate detection. Even a traditionally mundane sector, like utilities, has been a top market performer this year, largely driven by the growth of energy-hungry AI data centers. In finance, AI has helped prevent fraud, while it has improved supply chain efficiency for retailers. Whether we are ready or not, AI is poised to impact nearly every corner of the economy.

Will AI replace jobs?

One common concern is the potential for job displacement as AI evolves and expands. A recent Pew Research survey found that over half of workers say they’re worried about the future impact of AI use in the workplace, with one third believing it will lead to fewer job opportunities in the long run. However, a survey from the Federal Reserve Bank of Dallas suggests that may not be the case. This survey found that nearly two-thirds of company executives said AI has not affected their need for workers. Only 8% reported a reduced need for employees, and 3% said their workforce needs had increased. From the Industrial Revolution to innovations like automobiles and the internet, history shows that technological change usually reshapes the labor market for the better, adding more jobs than it eliminates. We expect the same from AI. Rather than replacing jobs, AI is more likely to help people work more effectively, augmenting existing roles while creating entirely new kinds of work.

For example, rising power demand, driven by the growth of AI, will likely create meaningful job growth by 2030. As more industries shift from fossil fuels to electricity—part of a broader push toward electrification—and the acceleration of the data center buildout, Goldman Sachs estimates the U.S. will need to fill over 500,000 new jobs to satisfy the growing demand for power.

AI Exposure Internationally

While many associate AI with a handful of U.S. tech giants, several globally listed firms—like Taiwan Semiconductor (TSMC), ASML, and Samsung—are major players in AI. Many of Blue Trust’s international funds include these companies, which power everything from advanced chip manufacturing to enterprise-level AI software. In this way, AI exposure in a portfolio can come from many corners of the world. TSMC, for example, is vital to the AI ecosystem, producing the majority of the world’s semiconductor chips and serving as a key supplier to firms like Apple and NVIDIA. ASML, based in the Netherlands, is another key player, supplying the manufacturing equipment necessary to produce the world’s chips. At the end of July, Samsung, a Korean company, finalized a deal to manufacture AI chips for Tesla. In China, firms like Baidu and Alibaba are major users of and investors in AI.

Thematic Funds

If investors choose to pursue exposure through an AI-themed fund, there are several things to keep in mind:

- Differences in holdings. The two top-performing AI funds this year have just one company in common in their top ten holdings.

- Variations in position weights. The concentration of fund holdings can vary. In early August, of the two best-performing AI funds, one had a top position weight of 4.5%, while the other’s top weight exceeded 10%.

- Geographic exposure. Investors should note that some AI funds invest globally, while others do not.

- Fee differences. Among the AI funds we reviewed, fees ranged from 0.47% to 0.75%.

- Performance. Investment themes can fall out of favor and underperform the broader market. Even funds tracking the same theme can produce markedly different results. Year-to-date, as of early August, the worst-performing AI fund is trailing the best-performing fund by nearly 40%.

Blue Trust AI Exposure

Our portfolios provide broad exposure to the full spectrum of AI―without the need to hold individual companies or specialized funds―so investors can still participate in the AI story through leading firms from the U.S. and around the world. We believe the most effective way to benefit from AI innovation is through a diversified portfolio that captures upside potential while reducing the risk of being overconcentrated in any single stock.

If you have questions about your specific portfolio, please reach out to your advisor. If you do not have a Blue Trust advisor, please contact us at info@bluetrust.com or 800-841-0362.

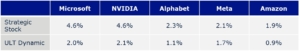

Blue Trust offers a variety of portfolio options depending on a client’s objectives, risk tolerance, time frame, and preferences. Below is Blue Trust’s exposure to select U.S. companies in the AI Industry in two of our portfolios (as of 7/31/2025).

For more insights and real-time reflections, follow Brian McClard, Chief Investment Officer, on X (formerly Twitter).

CAS00002039-08-25

Leave a Reply

Want to join the discussion?Feel free to contribute!