Greenback Dips, Payrolls Slip: Assessing Dollar Reserve Status and Labor Market Developments

Executive Summary

The U.S. economy continues to navigate a complex landscape shaped by shifting monetary policy, evolving global trade dynamics, and technological innovation. After an extended period of strength, the U.S. dollar has softened this year, reigniting debate over its role as the world’s reserve currency and the implications for investors.

Despite tariff tensions, foreign demand for Treasuries remains firm. The new GENIUS Act, establishing a federal framework for dollar-backed stablecoins, could generate more than $1 trillion in additional Treasury demand by 2030.

Meanwhile, the Federal Reserve (Fed) cut rates in September as softer jobs data—including downward revisions and a rise in unemployment—shifted its focus from inflation toward labor market risks. Consumers remain resilient as artificial intelligence (AI) continues to emerge as both a disruptor and a driver of growth—raising concerns about its impact on jobs while also unlocking opportunities for long-term productivity gains.

Blue Trust Insights

Dollar Reserve Status

For the first time in years, the U.S. dollar has experienced an extended period of weakness, declining by more than 10% this year against a basket of major currencies. In the short term, a weaker dollar benefits U.S. exporters as their goods become more attractive to foreign buyers. However, over the long term, some investors worry that this trend could signal a prolonged period of dollar weakness, fueled in part by tariffs and trade tensions. Concerns focus on the potential for the dollar to lose its status as the world’s reserve currency, possibly replaced by a BRICS-backed currency—a coalition of emerging economies collaborating on economic and development initiatives.

Contrary to what some believe, the loss of reserve currency status does not mean it’s “game over” for the U.S., as countries that have previously lost reserve status have continued to prosper. Although the BRICS alliance has drawn attention, the group appears to have little desire to create a currency to rival the dollar. Of course, certain actions taken by the U.S., such as freezing Russian-owned dollar reserve assets, have likely spurred a modest shift away from dollar reserves.

As we highlighted last quarter, there has been a meaningful increase in gold holdings among global central banks, corresponding with the seizure of Russian assets. Despite a slight decline in dollar reserves held by foreign central banks, the dollar remains a central player in global trade settlement, with over 50% of global trade invoiced in U.S. dollars. Although its share of global trade and central bank reserves may decline slightly over time, we believe the dollar will remain the dominant currency for the foreseeable future, supported by several factors. The dollar remains the most stable, liquid, widely accepted currency in the world and is supported by the U.S.’s dominant military, dynamic economy, and strong legal system.

To be replaced, one must first ask the obvious question: what could replace it? From our perspective, there is no viable alternative. A reserve currency derives its strength from a robust economy, trusted institutions, and political stability. China’s economic strength makes the renminbi the most obvious potential challenger to the dollar. However, currency manipulation, limited convertibility, and reliance on exports make reserve currency ambitions unlikely—since such a move would likely strengthen the renminbi and undermine China’s export competitiveness.

A shift to a multicurrency global system is possible, but it would take time, structural reforms, and broad international cooperation. While we do not expect the dollar’s dominance to be displaced anytime soon; further weakness is possible as it remains overvalued. If the dollar slides further, then it would continue to bolster international equities, which have posted strong year-to-date returns.

Treasury Auctions and Stablecoins

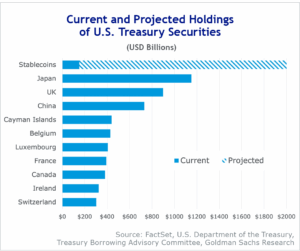

The April 2 Liberation Day tariff announcement and subsequent retaliatory measures likely prompted some to question the U.S.’s reliability as a trading partner, reinforcing investor concerns that foreign nations might pivot away from U.S. markets. Despite this sentiment, foreign holdings of U.S. Treasuries have remained stable since April, and strong foreign demand at Treasury auctions suggests continued confidence in the U.S. market.

Additionally, the passage of the GENIUS Act in July creates a new source of demand for U.S. Treasuries. The act establishes the first comprehensive federal framework for regulating U.S. dollar–pegged stablecoins, requiring issuers to maintain 100% of reserves in high-quality liquid assets such as short-term Treasury securities. This legislation aligns with President Donald Trump’s January 2025 executive order, which had a stated goal of “promoting and protecting the sovereignty of the U.S. dollar, including through actions to promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide.” Stablecoins can be exchanged globally and are always tradable, unrestricted by traditional market hours. Estimates vary, but most analysts expect stablecoins to account for over $1 trillion in U.S. Treasury holdings by 2030, driven largely by foreign savers seeking access to digital dollars.

The Federal Reserve’s Balancing Act

Bringing down inflation has been the Fed’s top priority for more than three years. However, in recent months, concerns about the labor market have grown, leading some to question whether the Fed has kept rates too high for too long. Despite verbal attacks on Fed Chair Jerome Powell from the President, it’s important to note that the power to raise or lower rates does not rest solely with the Fed chair. Instead, 12 members of the Federal Open Market Committee (FOMC)—comprising Board of Governors members and Federal Reserve Bank presidents—vote on changes to the Fed’s policy rate. You can read more about the Fed’s structure in our recent blog.

In July, two members of the FOMC dissented, voting in favor of a rate cut, marking the first double dissent in over 30 years. Weeks later, during his annual Jackson Hole address, Powell stated that inflation risks are tilted to the upside (a higher chance of inflation running hot) and risks to employment to the downside (job growth is more likely to weaken), noting that “the shifting balance of risks may warrant adjusting our policy stance.”

While balancing the Fed’s dual mandate to promote maximum employment and stabilize prices creates a challenge, comments from Powell and other Fed officials suggest the Fed has shifted its focus toward the labor market. Several weaker-than-expected jobs reports led the Fed to implement a widely anticipated 25-basis-point cut on September 17.

Labor Market

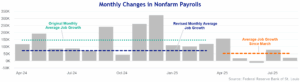

A disappointing August jobs report reinforced the Fed’s concerns about a softening labor market. The report included a downward revision for June’s data, showing a loss of 13,000 jobs. In September, the Bureau of Labor Statistics’ (BLS’s) annual benchmark adjustment revealed that companies created 911,000 fewer jobs than expected during the year ending in March 2025. Importantly, the revision does not mean jobs were lost but that they were initially overstated. However, this data suggests that job growth from April 2024 to March 2025 averaged just 73,000 per month, roughly half the earlier estimate of 149,000. As a result, the modest 53,000 monthly pace since March appears less weak, only slightly below earlier months when unemployment rose gradually despite faster labor force growth.

Despite the relatively soft jobs data, the unemployment rate remained stable through July, hovering between 4.0% and 4.2% over the last year. In August, the rate rose to 4.3%, the highest level since 2021. While notable, there are likely several factors weighing on the labor market. For example, reduced immigration into the United States has played a significant role, as it has been a key driver of labor supply growth in recent years. With fewer new workers entering the country, slower labor force expansion has helped keep the job market in balance even as demand for workers has softened.

The Congressional Budget Office estimates that from 2021 to 2024, the U.S. population grew by roughly 7.3 million “other foreign nationals,” compared with an annual average of around 100,000 before the pandemic.[i] That average has dropped to 27,000 per month under President Trump. Reduced immigration lowers the number of new jobs needed each month to maintain a steady unemployment rate. During Powell’s September press conference, he stated that the break-even rate of payroll growth might be between zero and 50,000 jobs per month.

Another factor is the Trump administration’s efforts to reduce the size of the federal government workforce. In 2024, government jobs accounted for more than 30% of monthly job gains, on average. This year, federal agencies have reduced payrolls as part of broader efforts to downsize, including positions identified by the Department of Government Efficiency. While recent job gains have been modest, they may prove sufficient to keep the unemployment rate contained.

Finally, tariff policy uncertainty has likely weighed on labor demand, as businesses struggle to plan amid an unpredictable outlook.

Data integrity

President Trump made headlines during the third quarter when he fired the head of the BLS. Critics argue this move could undermine trust in key government statistics. We understand the concerns around data integrity; however, we are more concerned with the integrity of the BLS’s data collection than with its leadership. Many have long reported that the BLS is underfunded and understaffed. Declining participation in government surveys suggests that the accuracy of monthly inflation and labor reports may be diminishing. In September, Powell noted that higher survey response rates are essential for reducing data volatility. For example, the survey that determines monthly nonfarm payrolls now receives responses from less than 43% of participants, down from 61% in 2015. The BLS plans to modernize how it collects data for the Current Population Survey, which is used to calculate the unemployment rate. The bureau expects to implement the change in 2027. While a public leadership shakeup can be unsettling, restoring public trust in government data is best achieved through increased funding for data collection and modernization.

Looking Ahead

Consumer Resilience

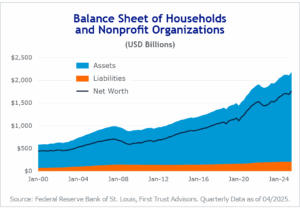

Encouragingly, consumers continue to show resilience. In the second quarter, household net worth reached a record high, boosted primarily by equity market gains. At the same time, household debt levels fell to their lowest level since the 1960s, highlighting the overall financial strength of U.S. households.

While consumer spending has cooled relative to 2024, it remains positive. Importantly, consumer discretionary firms have not signaled material weakness on recent earnings calls, with management teams maintaining an optimistic outlook. Some companies revealed that pressure is evident among lower-income households, but overall sentiment remains constructive heading into year-end. In the months ahead, we will closely monitor retail sales, layoffs, and unemployment claims for potential signs of weakness.

AI’s potential impact

Nearly three years after ChatGPT’s debut, companies continue to invest heavily in AI. While those investments have yet to deliver a breakthrough moment, many firms report efficiency gains in areas such as advertising and inventory management. Ultimately, if the expected surge in productivity fails to materialize, we would expect equity valuations to recalibrate lower.

Many worry that AI could trigger significant job losses. However, as we noted in a recent blog post, history suggests that technological advancements tend to reshape the labor market for the better, ultimately creating more jobs than they eliminate. Although the timing is uncertain, we anticipate that AI will reshape the labor market in the years ahead, creating opportunities that we cannot yet imagine.

Beyond the labor market, U.S. investors are concerned with government debt levels, unfavorable demographics, and rising health care costs. While these concerns are valid, we maintain an optimistic view: AI has the potential to help address these challenges, among others. For example, what if AI enables health care professionals to deliver medical care at a fraction of its current cost? In 2023, U.S. health care spending accounted for 17% of the country’s gross domestic product (GDP), compared with 11% for peer countries. Clearly, reducing health care costs while improving quality could ease a substantial burden for American consumers.

We can also anticipate similar efficiency gains across other sectors of the economy. Developed countries continue to face demographic challenges, as couples are having fewer children than in previous decades, partly due to the increased cost of raising a family. An AI-driven reduction in the cost of goods and services could encourage a “baby boom” if families feel more financially secure. Moreover, productivity gains from AI would support stronger economic growth, helping to ease concerns about national debt. We continue to believe that human innovation will chart a path toward a more prosperous future―potentially with the help of AI.

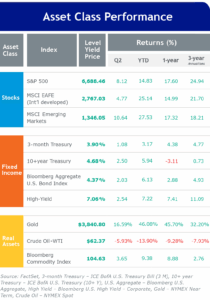

Economic and Market Recap

U.S. stocks performed well during the third quarter, though they continue to trail international peers year-to-date. Gold remained strong, rising nearly 17%, and commodities saw positive returns. Bitcoin increased 6% while small-cap companies, which are more sensitive to interest rate moves, began to outperform as expectations for Fed rate cuts increased. Markets rallied following the Fed’s 25-basis-point cut in September, and bond markets also performed well and remain positive year-to-date. While markets have recently reacted more to jobs data, inflation remains a key focus as tariffs continue to ripple through the economy.

U.S. companies posted earnings growth of nearly 12% year-over-year in the second quarter, marking the third consecutive quarter of double-digit growth. The Magnificent 7 saw impressive earnings growth of nearly 27%, slightly below the 31% average over the prior four quarters. Tariffs remained a key topic on company earnings calls, though mentions of the term decreased from the first quarter. Despite trade-related concerns, over 81% of companies beat earnings estimates—the highest percentage since the third quarter of 2023. Looking ahead to 2026, analysts have raised earnings estimates by 1.2%.

Despite trade policy uncertainty, the economy has shown resilience. GDP growth remains positive, supported by steady consumer spending and the expansion of AI infrastructure, which is contributing to growth and investor optimism.

Recent softening in the labor market may reflect the sharp slowdown in immigration, as a smaller workforce reduces the break-even pace of job creation. Hiring has cooled amid uncertainty, but layoffs remain limited. Lower interest rates could encourage hiring by easing firms’ costs, and resolving tariff disputes might further bolster business confidence. Although the Fed’s September cut offers relief, upcoming inflation and employment data will provide a clearer picture of the path forward.