Home Ownership: Locked out of the American Dream

Home ownership is often seen as a key piece of the American Dream. Beyond helping homeowners build equity for their own financial well-being, homeownership also delivers meaningful benefits to the broader community. Homeowners tend to move less often than renters, which helps create more stable neighborhoods. They are also more likely to be engaged in their communities, fostering stronger social ties and a greater sense of connection. As a result, high levels of home ownership can help individuals pursue their dreams while strengthening social and neighborhood cohesion.

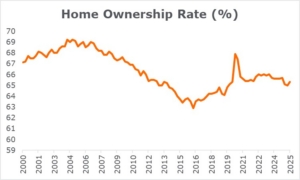

Today, however, we are experiencing a decline in home ownership due to affordability challenges and demographic shifts. We’ll explore what’s driving this trend and examine solutions and recent proposals intended to unlock this piece of the American Dream.

Upon Closer Inspection

The basic principles of economics apply to housing, too. Home prices are shaped by supply and demand, along with how much inventory is available. For buyers, affordability involves not just the home price but also mortgage rates, insurance, and property taxes, which all add to the total cost.

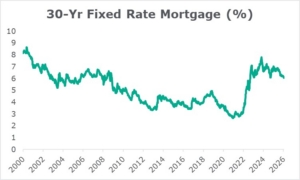

On the supply side, available housing comes from both existing homes and new construction. Mortgage rates also affect the supply of existing homes because many current owners hold historically low rates and may be reluctant to sell if it means taking on a new mortgage at a higher rate.

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

The chart above shows the overall home ownership rate, but it does not fully capture how low the rate of ownership is among younger generations and first-time buyers. According to the National Association of Realtors (NAR), the median age of first-time home buyers rose to 40, up from 38 the prior year and 31 in 2014. Other studies place the typical first-time home buyer in the low 30s and suggest the age has remained stable over time. Either way, today’s buyers are up against high home prices.

Home prices have climbed sharply, with the median U.S. sales price increasing 39% from January 2019 to July 2023 and showing little sign of easing. During the first two years of COVID, mortgage rates fell below 3%, helping fuel both home purchases and rising prices. As inflation took hold, rates increased rapidly, surpassing 6% by the fall of 2022. Today’s rates remain among the highest in the last 25 years.

Source: Federal Reserve Bank of St. Louis

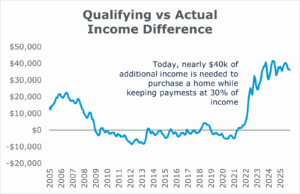

The combination of high home prices and elevated mortgage rates put home ownership out of reach for many Americans. Add in taxes and seemingly ever-rising insurance costs, and affordability can be a stretch, even for those with steadily rising incomes.

The Atlanta Federal Reserve calculates the “affordability gap” that compares actual national median income with the income needed to purchase a median-priced home while keeping house costs at 30% of income. The chart below highlights the substantial gap. With a median income of around $85,000, a typical buyer would need to earn over $120,000 to afford a median-priced home. By this measure, today’s affordability gap is the widest it has been in at least 20 years.

Source: Federal Reserve Bank of Atlanta

Trial Balloons and Proposals

Although home prices have remained relatively steady, mortgage rates have eased somewhat in recent months, but not enough to meaningfully improve affordability. With the midterm elections approaching this fall, everyday concerns such as food prices and housing affordability have garnered attention. The Trump administration has offered several ideas aimed at addressing housing costs. Helping buyers without increasing supply may ease affordability in the short term, but it could ultimately inflate home prices.

Many of the proposals focus on the demand side by attempting to reduce buyers’ costs, either by lowering mortgage rates or monthly payments, or by freeing up resources to purchase a home. One of the first ideas floated was a 50-year mortgage. While this would lower monthly mortgage payments, it would dramatically increase total interest paid over time and slow the pace at which homeowners build equity. Another proposal involved making mortgages portable, allowing homeowners to transfer their existing mortgage and rate to the new house. This concept raises significant logistical challenges and may not align with the current mortgage-backed securities (MBS) market. If workable, however, this could help existing homeowners trade up while freeing up entry-level homes for first-time buyers.

While monthly mortgage payments tend to be a focus for new buyers, down payments can also be a barrier to home ownership. Some in the administration suggested allowing the use of 401(k) assets for home purchases, though others, including the president, expressed reservations. Such a move would reduce retirement savings, and many plans already allow participants to take out loans against their balances. Plus, first-time homebuyers with IRAs can already withdraw up to $10,000 without penalty.

In January, President Trump directed Fannie Mae and Freddie Mac to purchase $200 billion in MBS to lower mortgage rates. While MBS yields declined modestly, the purchases represent only about 2% of the overall U.S. MBS market. In addition, Fannie and Freddie would have needed to sell other securities to fund the purchases. At the margin, this may have helped slightly lower rates, but it won’t substantially improve affordability.

Supply-side initiatives are likely to have a greater impact. McKinsey & Company estimates the U.S. faces a housing shortage of 8.2 million homes. However, construction is primarily shaped by local and state regulations, which can significantly constrain new supply. Without an increase in supply, affordability challenges are likely to continue, as highlighted in studies by McKinsey, Harvard, and others. The Bipartisan Policy Center estimates these regulatory costs can account for nearly 25% of the price of a new single-family home.

The administration has also proposed increasing the supply of homes available to individuals by limiting purchases by large institutional investors. Some real estate funds allocate a portion of their portfolios to housing, including multifamily, senior living, student housing, and even single-family homes. However, institutional ownership can include individuals with a few properties to large firms owning thousands. According to HUD, institutions owning 1,000 or more homes account for only 3% of all investor-owned homes nationwide, a number that may not have much impact on overall affordability.

Bring it Home

Home ownership, a key aspiration of the American Dream, is increasingly out of reach for many. Lofty home prices and mortgage rates near 25-year highs have sharply reduced affordability, especially for first-time home buyers. Rising insurance premiums and property taxes have also added to the burden. Research suggests that expanding the housing supply would alleviate the affordability gap, but regulations, zoning laws, and other state and local constraints hinder new-home construction. However, revamping these constraints could take time.

In the meantime, the current administration has offered several ideas to address the issues. However, many of the proposals focus on helping demand and would offer only modest, incremental relief. They also come with tradeoffs, such as measures focused primarily on boosting demand, risk supporting higher home prices, while other ideas may lack the scale needed to have a broad impact.

We’ll likely hear of additional proposals, such as the recent “Trump Homes” idea aimed at expanding the rent-to-own market. Other solutions could include raising capital gains limits beyond the current $500,000 maximum or extending mass transit into lower-cost areas to gradually increase the supply of homes.

Although some of these solutions may incrementally help affordability, increasing the supply of homes appears to be the most effective long-term solution. At the same time, it is important to recognize that the surge in home prices since COVID has created substantial home equity for existing owners. Policies that improve affordability by lowering home prices may jeopardize that wealth. We want to unlock the opportunity for people to become homeowners, but the tradeoffs deserve careful consideration.

CAS00002565-02-26