Looking for Income from Your Investments? Try the ‘Bucket Approach’

November 29, 2019

Most investors expect two things from their investment portfolio: a future return by selling an investment at a value greater than the purchase price and a current return from their portfolio’s income. However, at Blue Trust, we don’t believe that relying on portfolio income is the best way to meet today’s cash flow needs. Here’s why…

First, let’s think about interest on bonds. An investor can increase their interest income from bonds by buying lower quality bonds that pay higher interest, which exposes them to more credit risk. Or, they may extend their bond maturities because bonds with longer maturities pay higher interest. In the low interest rate environment, we’ve seen in recent years, it is particularly tempting to go down this path. However, these responses may expose the investor to more risk in the bond portion of the portfolio, which is typically expected to provide stability and risk reduction. In addition, attempting to increase a portfolio’s interest income can lead to a portfolio more heavily weighted in bonds than is appropriate for the overall goal profile of the investor.

Next, let’s look at stocks and the dividends they provide. Chasing high dividends through stocks to produce more current income can have bad consequences. It’s important to understand what may drive a company’s high dividend yield. First, it may be the result of a large decline in their stock price due to a negative change in the company’s prospects that precipitated the stock price fall. A dividend cut may be coming to neutralize that fall. Second, higher dividend paying companies tend to have lower long-term growth prospects. Stocks are typically purchased for their long-term capital appreciation potential and a company’s return of cash to current investors through above average dividends may signal a lack of capital investment opportunities and diminished future growth prospects. Third, stocks with higher dividend yields tend to be more interest rate sensitive which implies their stock prices will be correlated with movements in the overall level of interest rates. Investors typically expect that characteristic from their bond investments but it’s not typically desired for stock investments. Finally, certain industry segments (utilities for example) include companies that generally have higher dividend yields. Too much emphasis on dividends might lead an investor to inappropriately overweight some industry sectors in their portfolio.

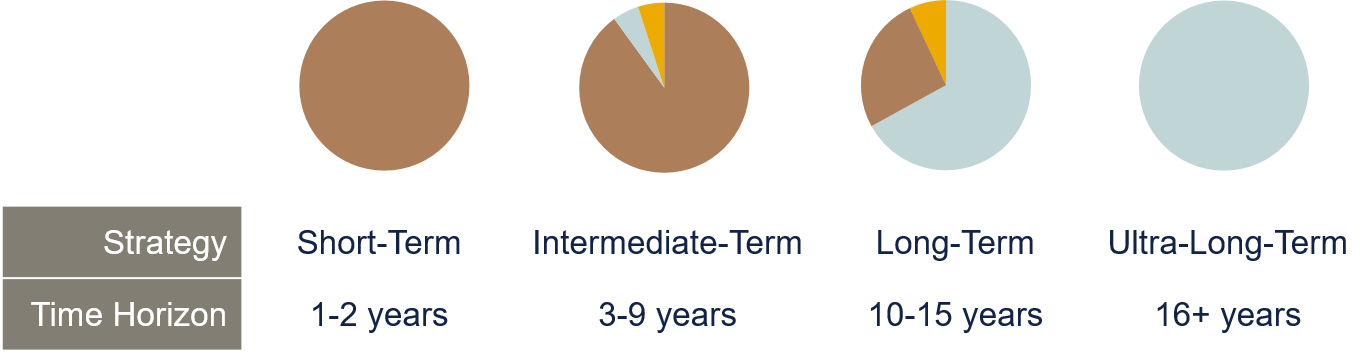

At Blue Trust, we recommend that investors take a different approach to meeting their short-term cash flow needs. We believe in a “bucketing” of their portfolio investments in line with the time frames associated with their goals. As such, investors should set aside the amount of liquid funds needed to meet the next 1 to 2 years of cash flow requirements in a Short-Term bucket. Those funds could be invested in money market funds or ultra, short-term bonds. Over time, intermediate and long-term oriented portions of the portfolio can be used to replenish that Short-Term bucket as it becomes depleted. This approach is illustrated below.

The portfolios in the chart are for illustrative purposes only and not meant to represent a specific asset allocation.

In this manner, longer term financial goals are best addressed with investments with greater growth potential (like stocks) while short and intermediate term goals are met with investments that are more stable and exhibit lower risk, like money market funds and intermediate term bonds.

It is certainly reasonable to expect your investment portfolio to provide for today’s cash flow needs. In our view, a bucketing approach better helps accomplish that goal compared with expecting portfolio income alone to satisfy that need.

9215822-11-19

Leave a Reply

Want to join the discussion?Feel free to contribute!