Has the Stock Market Bottomed Out?

Stock market declines, like the one we experienced this year, occur regularly. Since World War II, U.S. stocks have declined 10% or more from their all-time peak on 18 occasions—approximately once every four years. A couple of months ago, U.S. stocks were 25% below where they began the year. Although they have rebounded some, they remain down around 15% (as of 11/30/22). Naturally, investors are wondering if stocks will continue to recover or decline further. In this article, we’ll consider past drawdowns to provide some historical perspective on what could lie ahead.

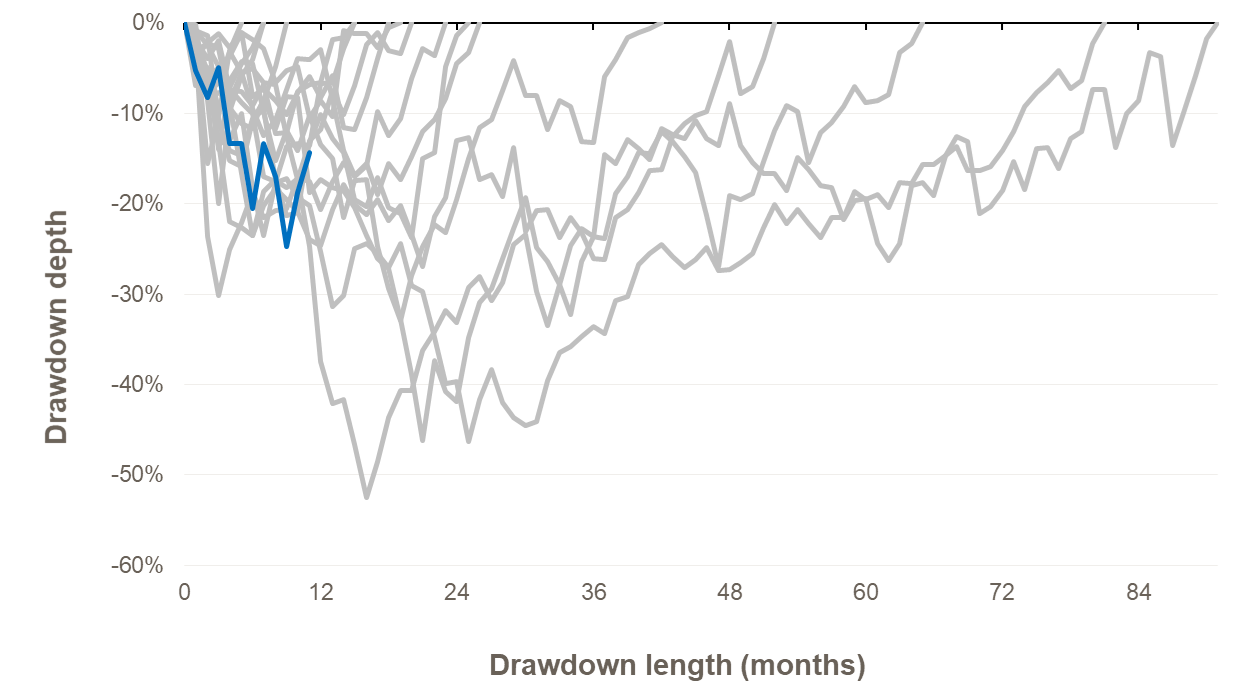

While we shouldn’t expect an exact repeat of the past, history can provide clues to what the future may hold. In the chart below, the blue line is the current drawdown. The gray lines are the previous 17 declines. In the median historical drawdown, stocks fell 20% and bottomed out in 11 months. The current drawdown’s trough is fairly similar—down 25% in nine months, but what happens from here will depend on the path of the economy.

U.S. Market Drawdowns Greater Than 10%

Source: FactSet, Ibbotson, as of 11/30/22.

Markets are forward-looking in the sense that prices reflect investors’ expectations of the future. However, stock prices don’t fully reflect recessions before they occur. Of the 17 prior drawdowns, 11 were accompanied by a recession. Among those instances, equities only bottomed out prior to the start of the recession on one occasion. Every other time, equities hit the bottom during or after the recession. Therefore, probably the most important data point to consider when evaluating if stocks have bottomed out, is whether the economy has or will experience a recession.

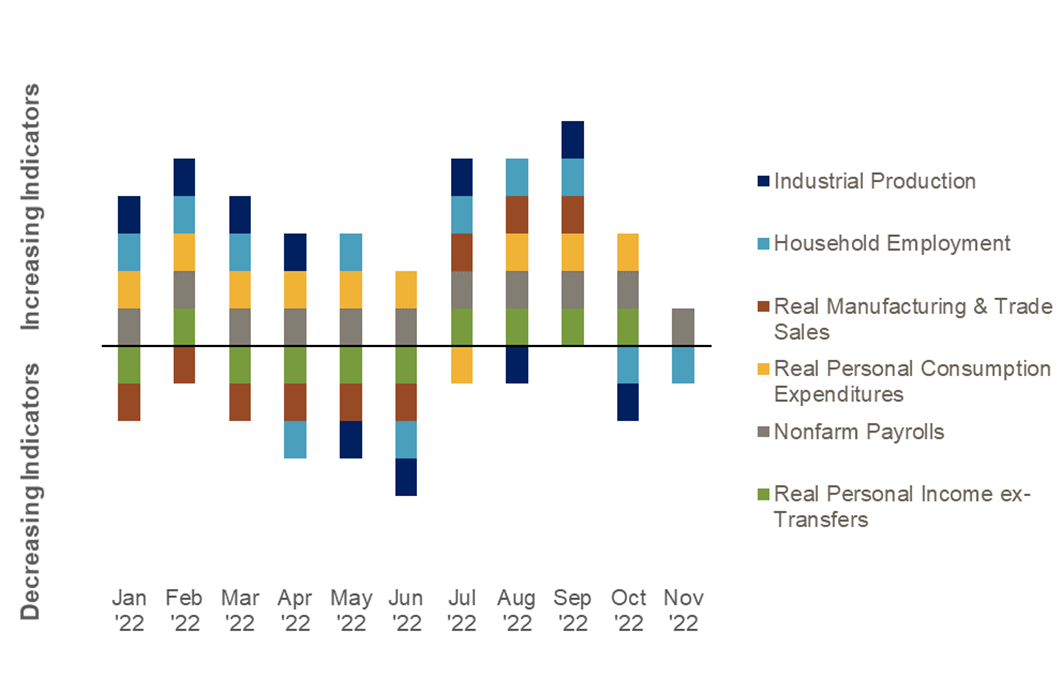

Although the U.S. met the technical definition of a recession (two consecutive quarters of negative Gross Domestic Product (GDP) growth) in the first half of 2022, it’s possible (arguably, likely) that the U.S. hasn’t yet experienced a conventional recession, which is defined by the National Bureau of Economic Research (NBER) as a “significant decline in economic activity that is spread across the economy and lasts more than a few months.” The NBER is the organization that officially determines recessions in the U.S., but unfortunately, their decision is typically made with a significant lag. However, if we look at the economic conditions that the NBER evaluates (charted below), they’ve shown little deterioration this year.

Monthly Change in NBER’s Recession Indicators

Source: FactSet, as of 12/2/22.

Looking ahead, it’s unclear whether the U.S. will experience a recession. What is certain is the U.S. economy has shown signs of weakness. Consumer spending (which accounts for roughly two-thirds of GDP) has continued to grow this year, but slowly, and business spending on long-lived assets has declined, dragged down by a sharp drop in residential construction. The housing sector is often the first area to decline as the business cycle nears its contraction phase, but due to its relatively small size housing alone cannot push the economy into a recession. Compared with the leadup to the 2008 housing crisis, lending quality is much stronger, and banks are far better capitalized, which will likely limit spillover to the financial sector this time.

When assessing recession odds, a key data point to monitor is inflation—due to its direct and indirect effects on consumers. Today’s high inflation is eroding income growth, such that continued increases in consumer spending are not sustainable. Currently, consumers are supporting their spending by increasing credit use and utilizing excess savings accumulated in 2020 and 2021, during the height of COVID. If inflation doesn’t recede before consumers exhaust their borrowing capacity and excess savings, spending will contract.

Making the situation even more precarious is the Federal Reserve’s (Fed’s) policy response to high inflation. The Fed is hiking interest rates to help cool inflation, but in so doing, they risk increasing layoffs, which could also tip the economy into a recession. It’s a delicate balance that the Fed is seeking to achieve, and Fed Chairman Jerome Powell admitted as much in his September press conference when he said, “We have always understood that restoring price stability while achieving a relatively modest increase in unemployment and a soft landing would be very challenging.”[1]

If the economy does enter a recession, the Fed’s actions still bear watching. In prior drawdowns that were accompanied by a recession, stocks never bottomed out while the Fed was still raising rates. Currently, the Fed believes that additional interest rate hikes are necessary to bring inflation back to its target, so the current market rebound could turn into a bear market rally.

While it seems like the stock market has been floundering for a while, previous drawdowns have taken up to 25 months to find a bottom, so it’s possible this drawdown could last significantly longer. Since many consumers and businesses locked in low interest-rate debt over the last couple of years and jobs and corporate earnings have yet to decline, consumers and businesses may be able to ride out high inflation and rising interest rates for a while. Of course, a recession is not guaranteed. There are indicators (such as falling commodity prices) that suggest inflation may abate quickly, which if sustained would increase the chance that a recession is avoided, and that’s our hope as we look forward to 2023.

Our investment team and advisors will continue to monitor the markets and economy as they always do. If you have additional questions, please reach out to your Blue Trust advisor or contact us at 800.987.2987 or email blog@bluetrust.com.