Is the U.S. Headed Toward Recession?

Entering 2025, the U.S. economy and market optimism were running high. However, President Trump’s “Liberation Day” announcement of “reciprocal” tariffs on April 2 jolted expectations. In the wake of the news, U.S. stocks plunged 12% as recession fears surged. Then, on April 9, after Trump announced a 90-day pause on reciprocal tariffs―for every country except China―stocks rallied almost 10%, recovering over two-thirds of their decline in a single day. By May 2, one month after Liberation Day, stocks had fully recovered, despite learning days earlier that the U.S. economy shrank in the first quarter. With so much volatility in the economy and market, what is one to make of this environment?

While we believe recession risks have increased due to higher tariffs, foreign retaliation, supply chain disruptions, and trade policy uncertainty, we still believe it’s more likely that the U.S. economy will avoid recession.

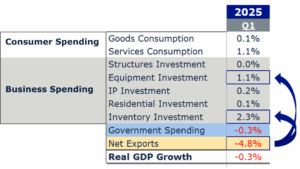

First, the economy entered April on solid footing. This isn’t evident by the 0.3% contraction in first quarter GDP (Gross Domestic Product), but this negative growth was solely tariff related. As businesses sought to front-run tariffs, imported goods surged 51%. The resulting deterioration in the trade balance detracted almost 5% (the most ever) from GDP, although this was partially offset by a related surge in inventory and equipment investment.

Source: BEA, FactSet (as of 5/7/25)

Oftentimes when evaluating GDP, economists prefer to exclude net exports, government spending, and inventory investment for a more reliable measure of consumer and business spending. This “core” measure of GDP (in green below) increased 3.0% in the first quarter, in line with prior quarters. However, due to the large increase in equipment investment, it’s likely overstated by about 1%. Nevertheless, if actual growth is around 2% that would represent a solid quarter.

Source: BEA, FactSet (as of 5/7/25)

Second, quarter-to-date data remains firm. The most recent employment report showed strong job growth and a steady unemployment rate in April. It’s likely too soon after Liberation Day to expect the labor market to be affected, but the data was encouraging, nonetheless. Also, most public companies have now reported Q1 earnings, which were strong. While some companies withdrew earnings guidance, due to heightened uncertainty, the percentage of companies issuing negative guidance was consistent with prior years. Despite analysts lowering second quarter earnings expectations slightly more than normal, they still expect nearly 6% year-over-year earnings growth in Q2.

Third, we seem to be past the peak of tariff uncertainty. This morning, U.S. and Chinese officials announced a 90-day pause on most tariffs and committed to further trade discussions. This announcement comes on the back of Thursday’s trade deal that the U.S. struck with the UK—the first trade pact since Liberation Day.

Despite the market recovery, risks remain. So far, the U.S. has only paused—not rescinded—reciprocal tariffs. If negotiations stall with other countries, especially China, tariffs could be reinstated. Given the deep economic interdependence between the U.S. and China, a breakdown in trade relations would increase the odds of a recession. However, for this reason, our baseline expectation is that both sides will reach a formal agreement.

Diversification is always a prudent strategy, but in times of heightened uncertainty, it becomes even more critical. While a diversified portfolio will inevitably lag the top-performing asset, it also avoids the worst performance—enhancing overall resilience. So far this year, U.S. stocks have been among the weaker performers, highlighting the value of diversification to portfolio outcomes.

While volatile markets and headlines can be unsettling, maintaining adequate short-term reserves and a well-aligned asset mix allows you to navigate inevitable market swings with confidence. If you would like to learn more about our investment philosophy or offerings or have specific questions about your portfolio, please contact your Blue Trust financial advisor. If you do not have a Blue Trust advisor and are interested in speaking with one, please reach out to info@bluetrust.com or call 800.841.0362.

For more insights and real-time reflections, follow Brian McClard, Chief Investment Officer, on X (formerly Twitter).

CAS00001753-05-25