Noncash Business Owner Giving

Written by Ryan Anderson, Private Wealth Advisor, and Blake Mankin, Financial Planner, in Blue Trust’s Houston, Texas office

At Blue Trust, we have the privilege of working with many business owners who prioritize generosity and have a desire to make significant gifts to churches and charities that they support.

Many clients choose to work with a Blue Trust financial advisor because of the biblical wisdom and technical expertise we provide in helping them free up resources to donate strategically. As a firm, we have a goal to assist our clients in giving away over $1 billion per year. Enabling generosity is built into the mission of why we exist. Business owners can play a key role in this process by looking beyond cash giving.

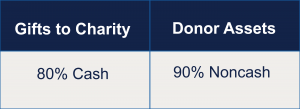

According to the National Christian Foundation (NCF), cash makes up only 10% of the assets owned by donors. The rest is held in assets such as stocks, mutual funds, real estate, and business interests.1

Most of the value within many major donor portfolios is contained in noncash assets.

On the other side of the equation, nonprofit organizations receive most of the gifts used to sustain their missions in cash. NCF estimates 80% of all donations are given in cash, with only 20% of gifts made through noncash assets.2

We see this trend as a remarkable opportunity for impact. When the minority of value held in donor portfolios is cash, but cash makes up the majority of giving in the United States, the opportunity for improvement is clear. At Blue Trust, we often find that many of our business-owner clients are unaware of the possibility to arrange their business strategy toward charitable giving prior to selling the company. In doing so, they can potentially generate significantly more generous donations and enjoy tax advantages in the process.

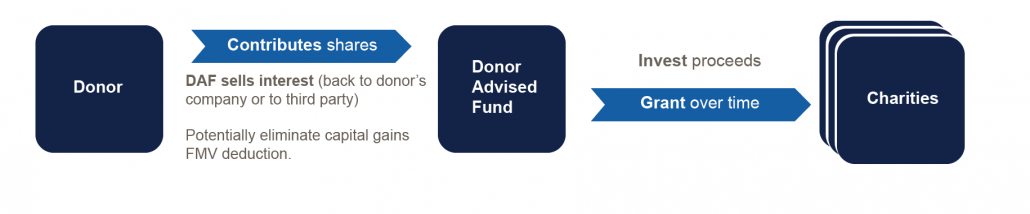

In many cases, business owners can gift a portion of their business to a donor-advised fund (DAF) prior to its sale. A DAF essentially creates a designated account within a foundation to then make gifts from over time. The owner can then sell assets, such as business interest, with the proceeds or ownership going directly to the DAF. Amazing groups such as NCF and The Signatry work with Blue Trust advisors and clients to help facilitate the opening of these accounts.

For business owners, giving through a DAF often means they can receive a tax deduction in the current year for the value of the business donation with any excess being used over a five-year period. At the close of the transaction, capital gains taxes on the portion donated to the DAF are eliminated if the gift is made correctly.

As an example, if a business owner gives 20% of a $10 million business into a donor advised fund, the $2 million worth of shares gifted can avoid taxation, as they are now owned by the DAF.

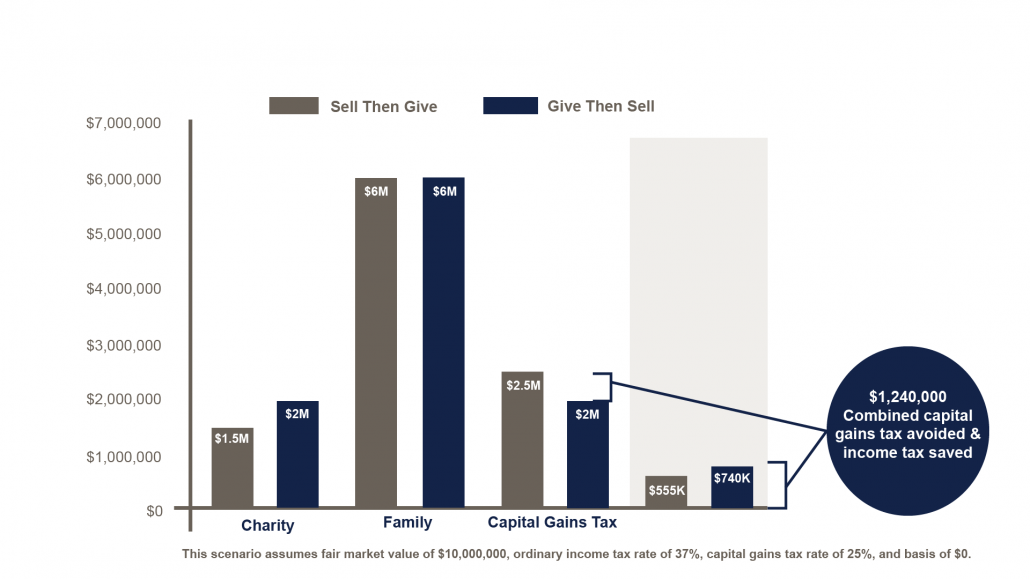

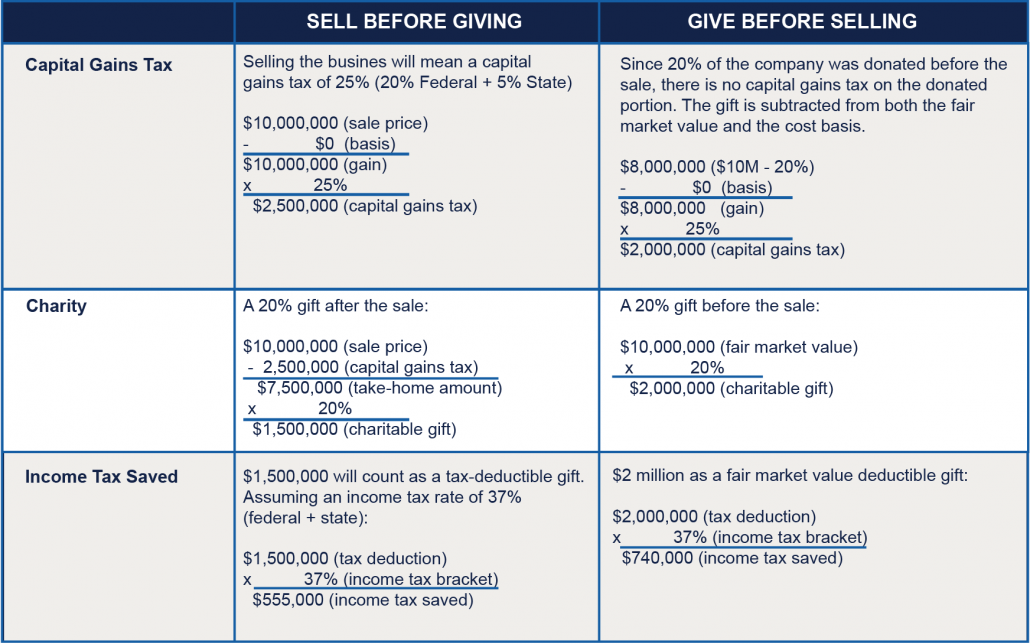

The graph below (provided courtesy of The Signatry) illustrates what a business owner could potentially save in taxes and increase in giving by selling the business and then giving.

The example below shows the impact if a family sold their business for $10 million and made a 20% gift either before or after the sale.

Evan Lange, president of the Midwest region for The Signatry, has a history of working with Blue Trust advisors and clients to make an impact with the sale of their businesses:

“We have helped family businesses increase charitable giving and lower taxes when selling or transitioning their business. Many business owners do not know the owner is able to donate shares of their company to a donor advised fund or charity before the sale,” Evan said. “By donating an interest in their business before the sale, the owner may be able to receive a large tax deduction (which lowers income taxes) and avoid capital gains taxes on the gift portion of the donation. Ultimately, this strategy helps owners grow their charitable gifts by lowering taxes.”

Matt Hames, chief strategy and marketing officer at NCF, another organization that helps many Blue Trust advisors and clients, explains it like this:

“Many families dream of giving significantly more to the charities they love, but that can sometimes seem hard to do. Charitable giving solutions using non-cash assets can often be a way to make this possible. At NCF, we support many advisors as they do the important planning work related to their clients giving intentions for their non-cash assets. Business owners desiring to be faithful stewards often find non-cash giving to be a powerful way to mobilize more resources than they ever thought possible.”

A few technical details:

- Owners need to gift and transfer shares prior to entering a binding obligation to sell the business.

- Typically, a person can hold shares within a DAF for five years.

- Most business owners have the potential to make these types of gifts regardless of their business structure, but differences do exist between how gifts are handled depending on the ownership structure. As an example, owners must consider debt for S Corporations when calculating the deductibility and value of the gifted shares.

- Owners usually need to obtain an appraisal of the business to determine deduction size. They must structure these transactions correctly, but the complexity is rarely a reason not to unlock the significant giving that comes as a result.

At Blue Trust, we have experience working with generous clients and helping them grow Kingdom impact. To strategically increase giving, we encourage business owners to work with their financial advisors as they explore how to exponentially increase their giving through noncash assets.

If you need assistance and would like to talk to a Blue Trust advisor, please contact us at 800.987.2987 or email blog@bluetrust.com or reach out to our business consulting team.

1https://www.ncfgiving.com/wp-content/uploads/2020/05/Major-Gifts-Guide-for-Charities.pdf

2https://www.ncfgiving.com/wp-content/uploads/2020/05/Major-Gifts-Guide-for-Charities.pdf

13711175-10-21