Strategic Generosity Using Stock Shares

Written by Ryan Anderson, Private Wealth Advisor, and Blake Mankin, Financial Planner, in Blue Trust’s Houston, Texas office

Blue Trust specializes in helping clients understand strategic approaches for giving generously to the ministries and charities they’re passionate about. Many donors are familiar with how to donate liquid assets like cash; however, they can also give through noncash options such as equity or stock shares in companies.

If the value of a stock has increased since the investor acquired it, the investor could donate more, but selling the shares might lead to a challenging tax issue. If the stock sells at a significantly higher price than the investor’s stock basis (what they originally paid), then the investor could face substantial capital gains taxes.

Advantages of Donor Advised Funds

When donating stocks, individuals may want to consider utilizing a Donor Advised Fund (DAF). A DAF is a gifting account within a foundation used to make donations over time. Gifts given to a DAF cannot be transferred back to the donor. The DAF assumes ownership of the gifted shares without any tax ramifications, and because the majority of DAFs are 501c3 nonprofit organizations, they can sell the donated shares in a tax-free manner. The proceeds from the sale are then credited to the donor’s account, and he or she can then distribute the funds to ministries or charities of their choice.

By giving through a DAF, investors can possibly avoid paying capital gains taxes on the donated shares, and they may have the ability to claim a charitable deduction for the total market value of these shares in the year they make the gift.1

Gifting Shares Through BlueGive

Blue Trust is pleased to offer BlueGive – a DAF with an easy-to-use platform and plentiful options for giving. Clients can search among a database of more than 1.5 million charities and donate stock shares to organizations that align with their charitable goals.

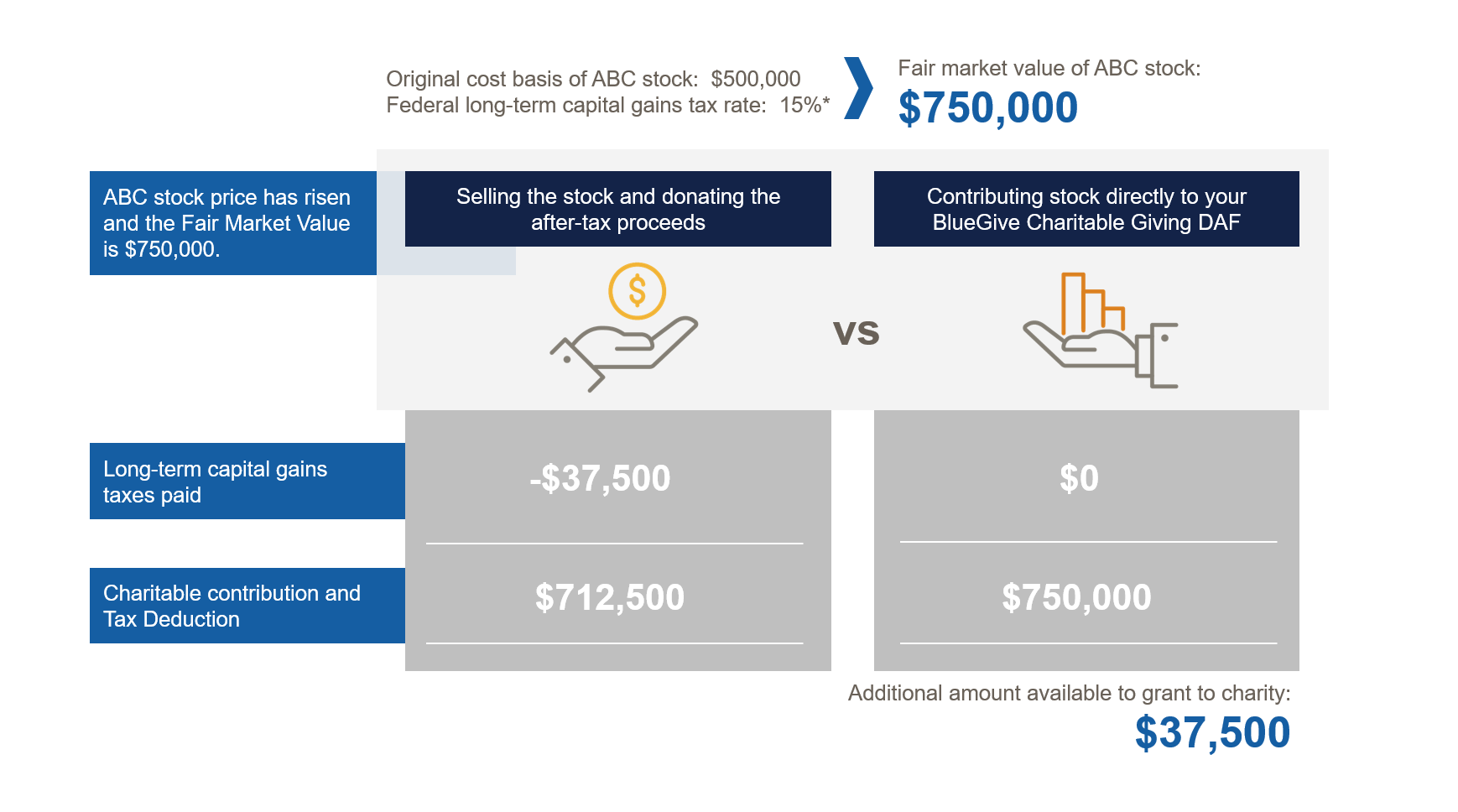

The graph below illustrates the potential tax savings and increased giving opportunities offered by a DAF. In this hypothetical scenario, we see a notable difference between donors using a DAF versus selling the shares on their own and donating the proceeds. While the sale proceeds are the same in both scenarios, the amount of capital gains tax avoided and income tax saved allow the donor to make a larger contribution to the charity. In this example, BlueGive would allow the donor to pass along the total sale proceeds of $750,000 to the charity. If the donor sold the shares on their own and paid the required capital gains taxes of $37,500, they could only donate $712,500 to the charity.

Donating Equity Shares Using a DAF

Hypothetical scenario of donating ABC stock to charity using a Donor Advised Fund through BlueGive:

*https://www.bankrate.com/investing/long-term-capital-gains-tax/#rates

ABC stock is used to represent a hypothetical stock and is not intended to refer to any specific stock. Examples of stock prices and capital gains tax are also hypothetical and do not reflect the actual cost basis, value of tax, or fair market value of any specific stock or fund.

Donating equity or stock shares offers a great opportunity for strategic giving. To better understand the benefits and potential downfalls, we recommend consulting your CPA or financial advisor to discuss the implications for your individual situation. If you have any questions or would like to find out more about setting up a BlueGive account, please reach out to your Blue Trust advisor. If you do not have an advisor, you can contact us at 800.987.2987 or email blog@bluetrust.com to speak with someone about BlueGive.