The Israel and Hamas Conflict: How It Could Impact Oil Prices

On October 7, 2023, Hamas initiated a surprise attack on Israel, killing more than 1,300 people and taking hostages back to Gaza. We are heartbroken by the loss of life and grieve with those who have lost loved ones. We pray for those who are suffering and join the rest of the world in praying that this conflict will end soon.

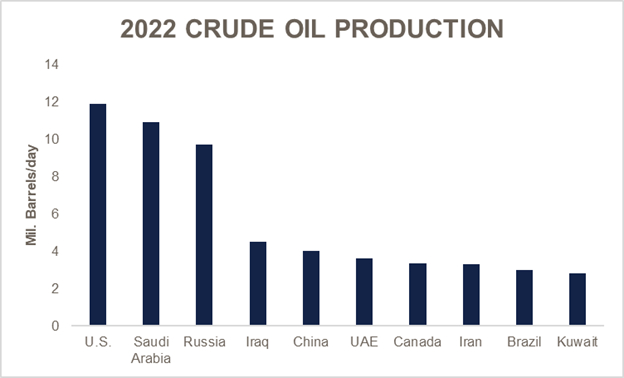

As investors, we must also look at this international conflict from an economic perspective to discern how the strife could impact our resources and investments. Given its Middle East location and oil-producing neighbors, disputes in Israel tend to raise questions about crude oil production and its effects on the broader economy. Although Israel produces very little crude oil, Saudi Arabia, Iraq, the United Arab Emirates (UAE), Iran, and Kuwait are all among the top ten oil producers in the world.

Source: EIA (U.S. Energy Information Administration)

A conflict solely between Hamas and Israel likely would have little impact on oil production in the region as neither produces oil in significant amounts. However, we are already seeing some decrease in energy production, and a broader skirmish that includes Iran, which has ties to Hamas, would significantly increase the risk to oil production. Existing sanctions on Iran prevent some oil sales, but additional restrictions would further impact the world’s oil supply. More importantly, Iran sits on the Persian Gulf with the all-important Strait of Hormuz, the narrow entrance to the Gulf. Oil producers in the Middle East ship roughly 17% of the world’s oil supply through this waterway that is 21 miles across at its narrowest point. Most of this oil is exported to Asia, but any negative impact to this outlet would most likely increase oil prices globally.

There had been progress toward developing closer relationships between Israel and several Arab countries. Israeli/Arab tension appeared to have ebbed until the Hamas invasion. Under the Trump administration, the Abraham Accords were signed on September 15, 2020, creating bilateral agreements between Israel and both the UAE and Bahrain. As a result, those countries recognized Israel’s sovereignty, and the nations established full diplomatic relations. Recently, Saudi Arabia and Israel were in negotiations to normalize relations, but those discussions were suspended since the Hamas incursion.

These negotiations are hopeful signs for the long term, but 50 years ago, the Yom Kippur War engulfed the Middle East. A group of Arab states, including Egypt and Syria, invaded Israel on the Jewish Holy Day. The United States supported Israel, and Arab members of OPEC (Organization of the Petroleum Exporting Countries) responded by enacting an embargo against the U.S. and other countries. The embargo led to high oil prices and oil shortages in the U.S. and also to the eventual creation of the Strategic Petroleum Reserve.

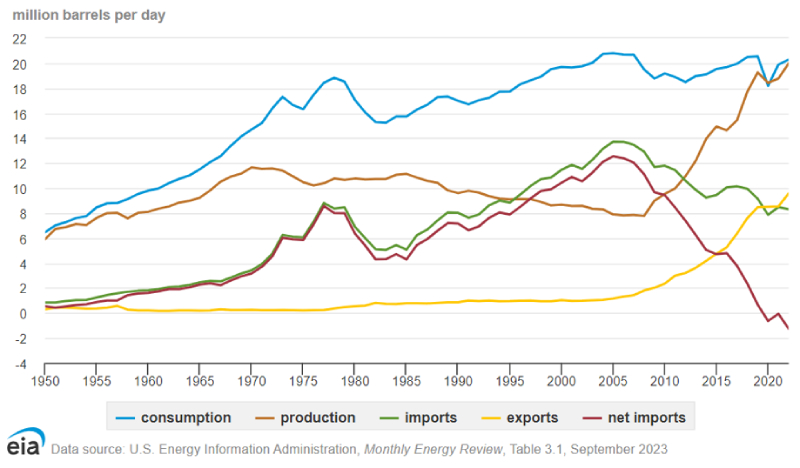

As the U.S. economy has grown, Americans have become more efficient consumers of energy, requiring fewer barrels of oil per unit of output. In parallel with declining energy intensity, the U.S. also has become a top producer of crude oil. Our oil imports have fallen steadily, especially since 2005, and reliance on Middle East oil has dropped even more dramatically (see chart below). The investment principle of human productivity was a significant factor in these production and efficiency dynamics. Technology and new drilling methods, including horizontal drilling and hydraulic fracturing (fracking), allow producers to extract more oil from wells, revolutionizing the industry.

U.S. PETROLEUM CONSUMPTION, PRODUCTION, IMPORTS, EXPORTS AND NEXT IMPORTS (1950-2022)

Events in the Middle East have the potential to reverberate worldwide if they escalate. Although the U.S. produces a significant amount of oil, any reduction in world supplies could increase prices and inflation, contributing to a slowdown in economic activity. Important questions remain unanswered. How will Arab countries react as the conflict unfolds? Besides the near-term focus and risk of Israel rooting out Hamas from Gaza, how will that territory be governed long term? What will the impact be on the rest of the world? Additional risks may arise beyond the Middle East. For instance, Russia and China may benefit as the U.S. becomes preoccupied with Middle East turmoil.

From an investment perspective, uncertainty is an accepted risk and one of the principles that helps us navigate the markets. We are closely monitoring the situation and are sensitive to potential escalation beyond the Israel and Hamas conflict. We’re continually assessing whether investment strategy changes are warranted. We don’t know what the future holds, but we can plan for it by diversifying our portfolios to increase the odds of meeting our goals regardless of current economic or geopolitical circumstances.

As with any investment strategy, there is potential for profit as well as the possibility of loss. Blue Trust does not guarantee any minimum level of investment performance or the success of any investment strategy. All investments involve risk and investment recommendations will not always be profitable. Diversification does not guarantee investment returns and does not eliminate loss. Past performance does not guarantee future results.