Perspective for the New Year: Economic Signals and Market Themes Shaping 2026

Executive Summary

The 2025 economic landscape was shaped by geopolitical tensions, tariffs, and a historic government shutdown, yet the markets remained resilient, with the S&P 500 closing up 18%. As we look ahead to 2026, key themes include the possibility of another government shutdown, tariff policy volatility, the path of monetary policy, and shifting trade dynamics, particularly with China.

The Federal Reserve (Fed) faces a delicate balancing act, as inflation remains above the 2% target and the labor market shows signs of softening. A change in Fed leadership could influence the direction of monetary policy, potentially increasing emphasis on rate cuts in response to employment concerns. The labor market remains uncertain, with tepid job growth, though recent unemployment claims suggest stability.

Looking ahead, the economy stands to benefit from continued advancements in artificial intelligence (AI), but inflationary pressures could cause consumer spending to slow, particularly for lower income households. As we approach the 2026 midterm elections, discussions around affordability are likely to intensify. Despite these challenges, there are still plenty of opportunities ahead.

Blue Trust Insights

2025 was a year marked by dramatic headlines that captured investors’ attention. War continued in Europe. Military strikes targeted Iranian nuclear facilities. The U.S. expanded its military presence in the Caribbean. Tariff rates climbed to their highest levels since the Great Depression. And the longest government shutdown in U.S. history brought federal operations to a halt.

The result? The S&P 500 closed the year up 18%—a powerful reminder that frightening headlines don’t always translate into poor market performance. In this update, we share our 2026 outlook and highlight key themes that are top of mind for investors in the year ahead.

Government Shutdown Impact

The fourth quarter brought the longest government shutdown in U.S. history, lasting 43 days. The impasse stemmed largely from disagreements between Democrats and Republicans over extending health care subsidies. Ultimately, lawmakers agreed to reopen the government after striking a deal to hold a vote on the funding before year-end. Lawmakers extended some programs, including SNAP benefits, through September 2026.

Another shutdown remains a possibility, as many agencies will require new appropriations by the end of January. Congress continues to work toward an agreement on health care subsidies after the vote to extend them failed in December, and President Trump has acknowledged Congress will likely need to continue the aid.

Fortunately, markets have historically been unfazed by shutdowns, and the most recent episode was no exception. The S&P 500 rose roughly 2.5% during the shutdown, reflecting investor confidence in the economy’s underlying strength and the relatively short duration of the funding lapse. While the shutdown will have a modest negative impact on gross domestic product (GDP) in Q4, the economy will largely recoup the loss.

Beyond sentiment, one of the most tangible effects of the shutdown was the disruption in government data collection, which hampers policymakers’ ability to assess the economy and make informed decisions. While shutdown risk looms early in the year, we expect any resulting data interruptions to be less severe than last year’s, as Congress appears motivated to avoid another prolonged standoff.

Tariffs and Trade

The outlook for tariff policy is uncertain but yet predictable. Uncertainty remains as the Supreme Court (SCOTUS) reviews the administration’s use of the International Emergency Economic Powers Act (IEEPA) to implement broad tariffs—potentially triggering refunds of over $100 billion to U.S. importers. If SCOTUS rules against the administration, the next step is predictable: the administration is prepared to pivot to other tools, such as Section 232 and Section 301 of U.S. trade law, to implement tariffs. So, while the legal mechanism may change, we expect the overall impact on trade policy to remain largely unaffected. If refunds occur, they could provide a modest stimulative effect on the economy, though a lengthy reimbursement process may blunt the impact.

Regardless of the ruling, we believe clarity from SCOTUS will be welcome news, assuaging uncertainty that has plagued sentiment for months. In the aftermath of Liberation Day, U.S. businesses cited tariff policy volatility as a major obstacle to hiring and long term planning, as uncertainty clouded economic visibility. Despite the challenging environment, S&P 500 profit margins hit 15-year highs in the third quarter, aided by pricing power, supply chain diversification, and AI-driven efficiencies. Trade negotiations also progressed, with recent deals covering food (Latin America), pharmaceuticals (U.K.), and autos (South Korea). We believe the trade agreements struck so far should provide firms with a relatively stable trade environment in 2026, though SCOTUS’s decision could inject new volatility.

Meanwhile, a potential renegotiation of the United States–Mexico–Canada Agreement (USMCA) also looms, with the first review of the trade agreement scheduled for July. After a hostile start to trade negotiations between the U.S. and Canada in early 2025, talks were put on hold by President Trump in October after Canada aired an anti-tariff TV ad inside the United States. President Trump has also voiced concerns with Mexico, calling for stronger efforts to curb the flow of drugs into the United States and encouraging higher tariffs on China. The latter issue was addressed in December, as Mexico approved new tariffs on imports from China and other Asian countries.

Regarding trade, the U.S. and China appear committed to a “rolling truce.” After reciprocal tariff increases pushed levies on Chinese goods to 145%, both sides agreed to pause retaliatory tariffs for one year. President Trump and President Xi Jinping of China are set to meet at least twice in 2026, with Trump heading to Beijing in April and Xi visiting the U.S. later this year.

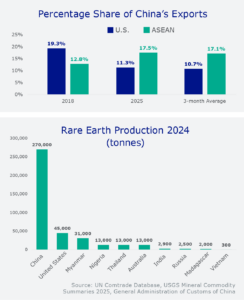

Despite ongoing talk of deglobalization, a full break in trade with China has become increasingly unlikely, reflecting how economically intertwined the two countries remain. The U.S. remains particularly reliant on Chinese rare earth minerals, while China has gradually diversified its export base toward other Asian markets. Since Trump’s first tariff increase in 2018, China has increased its exports to Association of Southeast Asian Nations (ASEAN) countries from under 13% to nearly 18%. Over the same period, the U.S.’s share of exports from China has declined from 19% to 11%. While the U.S. has its own reserves of rare earth minerals and access through allied countries, most analysts estimate it would take roughly 10 years to shift production away from China completely. We believe the administration is increasingly mindful of this reality and will seek to extend the truce beyond 2026 while continuing to strategically diversify away from China.

Federal Reserve and Inflation

The Fed faces a challenging balancing act in 2026. Both sides of its dual mandate are sharply in focus as the labor market shows signs of weakening and inflation remains above the central bank’s 2% target. Affordability concerns are also likely to remain prominent for policymakers as the administration navigates a midterm election year. Recent public attention to affordability issues has coincided with increased scrutiny of monetary policy, raising the likelihood of criticism levied at the Fed in the months ahead, particularly if rate cuts do not continue.

We expect the president to nominate a more dovish replacement for current Chair Jerome Powell, whose term ends in May. At the same time, recent comments from Fed officials reveal a clear divide among members on how to proceed on rate policy. It’s important to remember that while the chair plays a leadership role, monetary policy decisions are made collectively by the Federal Open Market Committee (FOMC), not by the chair alone. We explored the Fed’s structure in more detail in a recent blog post.

President Trump recently announced that he has made his decision on the new Fed chair and plans to make the announcement early in the year. Most analysts believe the president will nominate either Kevin Hassett, current head of the White House National Economic Council, or former Fed Governor Kevin Warsh. Compared with Chair Powell, both candidates favor greater policy easing, a stance that could result in a faster pace of rate cuts. Hassett has said that he will act independently but there is room to cut rates further. Some current officials, such as Fed Governor Christopher Waller, have also favored more easing, looking to get ahead of potential problems in the labor market. Still others remain cautious, worried that aggressive cuts could reignite inflation.

Powell has argued that tariffs will likely result in a one-time price increase rather than persistent inflationary pressure. While he has acknowledged that tariffs modestly contributed to price increases last year, the pass-through to consumers has been lower than the Fed expected. Powell has also emphasized that the broader economic effects of trade, immigration, fiscal, and regulatory policy changes remain uncertain, and tariff-related impacts on prices may emerge gradually as they work through supply chains. We expect the inflationary effects from tariffs and shelter costs to dissipate as the year progresses. As a result, we anticipate inflation moving toward the Fed’s 2% target by year-end. We also believe the employment side of the Fed’s mandate will take precedence this year, with the Fed likely to respond to potential labor market deterioration despite stubborn inflation.

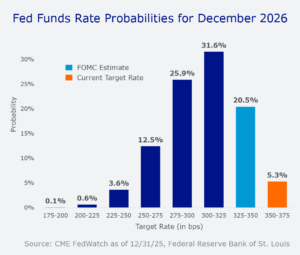

As expected, on December 10, the FOMC delivered a third consecutive quarter-point rate cut but signaled it may pause further cuts for now. Encouragingly, the committee raised its 2026 real GDP forecast by 0.5% and trimmed its core Personal Consumption Expenditures inflation forecast by 0.1%. Markets currently expect 50 basis points of easing in 2026, although the Fed’s projections suggest just one quarter-point cut. We believe two cuts are likely, with the potential for more if labor market conditions worsen.

Labor Market

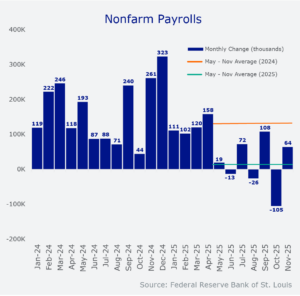

In the second half of 2025, monthly employment reports revealed tepid growth, with some months recording job losses. The labor market remains uncertain, with the Federal Reserve Bank of St. Louis recently suggesting that only 30,000 jobs per month may be needed to maintain a stable unemployment rate, primarily resulting from a sharp decrease in immigration.

At Fed Chair Powell’s post-meeting press conference, he said that monthly nonfarm payrolls could be overstated by as much as 60,000 jobs. If accurate, monthly job numbers could be negative, since job growth has averaged just 17,000 per month since May, a sharp decline from the 140,000 monthly average in 2024. As we’ve noted before, new immigration policies have been the most significant driver of change in the labor market. After accounting for more than half of net employment gains in 2024, foreign-born employment dropped by nearly 700,000 in 2025. The decline in federal government payrolls has also weighed on gains.

Encouragingly, both initial and continuing unemployment claims are following seasonal patterns, indicating the labor market is holding steady rather than unraveling. However, after remaining largely unchanged for a year, the unemployment rate began to tick up in the second half of 2025. In a low-hire environment, a growing labor force has pushed the unemployment rate higher, while the quits rate has fallen to its lowest level in more than a decade as workers hesitate to pursue new opportunities. We expect policymakers to be laser focused on the employment picture in 2026.

Economy and Consumer

Front-loaded fiscal easing from the One Big Beautiful Bill Act (OBBBA) and a potentially more accommodative Fed should help buoy markets in 2026. The CBO estimates that the OBBBA will boost GDP growth by 0.9% in 2026, driven primarily by businesses’ ability to immediately deduct capital expenses, such as investments in research and development and equipment. Additionally, analysts project tax refunds to be among the largest ever, providing a boost to consumers. At the same time, the delayed effects of rate cuts and a potential ramp-up in the administration’s deregulatory agenda could further support growth. We also anticipate ongoing AI advancements and broader adoption to drive productivity gains.

Real wage growth remained strong for much of 2025, helping consumers spend despite sticky inflation, though it has begun to cool, potentially limiting purchasing power in 2026. The latest Employment Cost Index shows the weakest reading since Q2 2021, signaling slower compensation growth as the labor market softens. Consumers have also benefited from wealth effects tied to strong equity markets—a risk in 2026 if market valuations compress.

Recent company earnings calls continue to cite evidence of a bifurcated economy, where high-income earners and luxury sectors thrive, while low- and middle-income households and basic businesses struggle. Some companies have also noted signs of stress among higher-income households. For example, 60% of Dollar Tree’s new customers came from higher-income households last quarter, according to its CEO. Walmart has reported a similar shift among its customer base in recent quarters. Weaker-than-expected consumer spending—with the economy increasingly reliant on higher-income Americans as lower-income consumers pull back—will be a key risk to watch in 2026.

As consumers have voiced frustration with affordability, the White House has begun to take notice. In December, several affordability related initiatives were announced, including a new investigation into food price-fixing to address inflation on grocery prices. The president has also suggested that the U.S. will look to increase imports of foreign beef to tame rising prices. In a surprising policy shift, Trump agreed to reduce tariffs on several products from Latin American countries, such as coffee and bananas, to ease price pressures. We expect affordability concerns to dominate the 2026 political conversation as candidates vie for voter support ahead of the midterm elections.

While inflation has fallen from its 2022 peak of 9.1%, prices remain well above pre-pandemic levels, frustrating consumers. This dissatisfaction, particularly in an election year, means more pressure on politicians to address Americans’ concerns. Despite the growing economic benefits of AI, the technology industry faces roadblocks, as some of the administration’s supporters oppose federal regulation and communities fear rising energy costs and land disruption associated with data center construction.

Analysts expect the S&P 500 to deliver 15% earnings growth in 2026, with nearly half of that increase coming from the seven largest stocks. Like in 2025, we expect some challenges along the way. As investors, it’s important to remember that over the last 45 years, the S&P 500 has experienced average intra-year drops of 14%. Volatility is likely to surface throughout the year as positive factors—such as the ongoing buildout of AI and anticipated double-digit earnings growth—face labor market concerns, elevated valuations, skepticism about AI, and election-year uncertainty. While 2026 offers compelling opportunities, investor success hinges on maintaining discipline and diversification amid optimism and volatility.

Market Recap

U.S. stocks performed well in the fourth quarter but overall lagged international peers by 15% in 2025. Gold posted another positive quarter, capping a 63% increase for the year, finishing slightly below its all-time high. Commodities rose 16% for the year with strong fourth-quarter returns. Bitcoin was strong for most of the year before collapsing in the fourth quarter. When the dust settled, the cryptocurrency was down nearly 7% for the year. Bond markets rose in 2025, with the broad index increasing more than 7%. In 2026, we believe markets will focus on the AI buildout and the direction of monetary policy.

In the 2025 calendar year, earnings rose 12%, surpassing the 10- year average of 8.6%. If S&P 500 earnings grow as expected in 2026, it would mark the third straight year of double-digit earnings growth. Overall, analysts expect the mega-cap Magnificent 7 tech firms to post growth of nearly 23% versus 12.5% for the other 493 companies in the index.

Analysts also project earnings growth across all 11 sectors in the new year, with information technology leading the way and AI giant NVIDIA contributing the largest earnings growth. Profit margins, already at record highs, are also expected to increase, rising to nearly 14%, according to FactSet. AI remained a key topic on company earnings calls in the most recent quarter and analysts expect it to dominate the conversation again in 2026.