Barriers, Bills, and Bullion: Breaking Down Trade, Legislation, and Gold

Executive Summary

After a sharp pullback in early April, U.S. and global equities advanced in the second quarter, as fears of a potentially imminent recession and tariff tensions eased. In June, leaders from the U.S. and China agreed to a trade framework, subject to final approval by both countries’ presidents. In addition, stronger-than-expected earnings and guidance helped lift stocks, which moved higher despite a slowdown in U.S. gross domestic product (GDP) growth.

President Trump’s temporary pause of reciprocal tariffs drove a quick recovery for U.S. stocks, while trade deal negotiations continued and uncertainty kept bond markets in somewhat of a holding pattern. Inflation was cooler than expected despite concerns that tariffs would cause a rise in prices.

After much debate, the One Big Beautiful Bill Act―President Trump’s flagship legislation that extends tax cuts, increases defense spending, and reforms some social programs―narrowly passed Congress, achieving the president’s goal of signing it into law by July 4.

In our view, concerns about inflation, a weakening U.S. dollar, potentially rising interest rates, and the perception that President Trump may be “backing down” in tariff negotiations are likely overblown, even if some foreign investors are pulling back on U.S. exposure. While we believe long-term risk to the dollar as the world’s reserve currency has increased, we continue to believe the dollar will retain its reserve status for the foreseeable future.

Blue Trust Insights

Trade negotiations and deals continue, along with legal challenges

The higher-than-expected tariffs announced on “Liberation Day” in April jolted investor sentiment and sent U.S. stocks sharply lower. However, they recovered quickly after Trump announced a 90-day pause on reciprocal tariffs. U.S. negotiators, including Treasury Secretary Scott Bessent, met with Chinese counterparts in May in Geneva, where both countries agreed to reduce their high tariffs, de-escalating trade tensions.

In June, U.S. and Chinese officials met in London, following a call between President Trump and Chinese leader Xi Jinping, and agreed to a framework for a trade truce. The agreement reportedly keeps tariffs at the levels agreed to in May, includes provisions for China to supply rare earth minerals and magnets, and allows Chinese students to attend U.S. colleges and universities. Although the deal is yet to be finalized, Trump says the U.S. will continue to impose tariffs on China at a rate of 55%, while China would maintain a levy of 10% against the U.S.

In May, the U.S. and the U.K. announced a limited trade agreement that left 10% tariffs in place but included some carve outs and reductions for agricultural products and British cars. In June, Trump and British Prime Minister Keir Starmer signed an agreement to lower some tariffs, including those on steel and aluminum, and eliminate tariffs on the U.K. aerospace industry.

Negotiations with the European Union (EU) remained uncertain. The U.S. had 50% tariffs on steel and aluminum imports, a 25% tariff on cars, and 10% reciprocal tariffs. However, Trump threatened to raise the 10% tariffs to 50% if a deal is not agreed upon soon, and the president also hinted at “sectoral tariffs” that could impact pharmaceuticals and semiconductors.

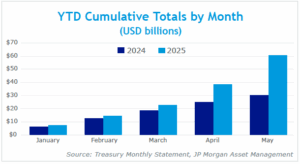

On July 2, Trump announced a trade agreement with Vietnam that imposes a 20% tariff on Vietnamese imports and a 40% tariff on goods transshipped from China. The structure of the deal offers insight into how Trump may approach other countries in the region on the issue of Chinese transshipments. Through May, tariffs have generated just over $60 billion in revenue—double the amount collected during same period last year.

Meanwhile, the U.S. Court of International Trade (CIT) ruled in late May that most of Trump’s reciprocal tariffs should be blocked, citing the misuse of an emergency law used to implement the tariffs. However, the U.S. Court of Appeals for the Federal Circuit extended a short-term reprieve for the administration as it continues to challenge the CIT ruling. The appeals court scheduled arguments for July 31. If the administration ultimately loses the case, we expect Trump would employ a variety of other laws to continue using tariffs in some form. The case may go the U.S. Supreme Court, where the administration would be expected to argue that the lower court’s decision would interfere with Trump’s authority to conduct foreign policy.

One Big Beautiful Bill Moves Forward

In May, the House of Representatives narrowly passed the One Big Beautiful Bill Act (OBBBA). The bill then moved to the Senate, where lawmakers adjusted tax provisions and social program reforms. Controversial elements from the House version—such as federal control over AI regulation and the so-called “revenge tax”—were ultimately removed. The Senate narrowly passed the revised bill, with Vice President JD Vance’s vote breaking a 50-50 tie. The House quickly approved the updated version, and President Trump signed it into law on July 4.

The bill delivers on several of Trump’s prominent campaign promises by extending key provisions of the 2017 Tax Cuts and Jobs Act, excluding tips and overtime from federal income tax, and boosting spending on immigration enforcement and defense. Some lawmakers raised concerns about the bill’s fiscal impact, with the Congressional Budget Office (CBO) projecting a $3.3 trillion deficit increase over 10 years. Supporters, however, argue that the CBO’s assumptions are overly pessimistic. In a separate analysis, the CBO estimated Trump’s proposed tariffs could reduce the deficit by $2.8 trillion, though at a cost to economic growth. The White House noted that while the OBBBA includes $1.7 trillion in mandatory savings, it cannot cut discretionary spending through the budget reconciliation process. To learn more about our thoughts on the OBBBA, read our recent blog.

DOGE to continue in the wake of Musk’s exit

After making headlines across much of the first half of the year, the Department of Government Efficiency (DOGE) saw some of its biggest news in June, with the breakdown of the alliance between Tesla CEO and DOGE leader Elon Musk and President Trump, when Musk officially left his role as a special government employee.

The DOGE website reports an estimated savings of $190 billion, though the exact figure is heavily debated and unclear. Both the administration and Musk said that DOGE’s work will continue with the goal of reducing the deficit to 3% of GDP.

The House narrowly passed the “DOGE Cuts” bill, which aims to claw back over $9 billion in spending, including reductions in foreign aid and funding for the Corporation for Public Broadcasting, which partially funds NPR and PBS stations. The bill is still pending in the Senate, where it has faced some pushback from moderate Republicans.

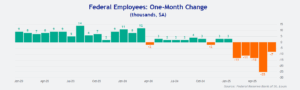

DOGE has also had a clear impact on federal employment to start the year. In June, the economy added 147,000 jobs and maintained a steady unemployment rate, while federal government employment fell by 7,000 for the month and 69,000 year-to-date. A larger decrease will likely show up in the fall, as federal employees who accepted a buyout offer are still considered employed through September 30.

Looking Ahead

Tariffs and inflation: So far, so good

U.S. consumer prices increased less than expected in May, with the Consumer Price Index showing a 0.1% increase over April and a 2.4% rise year over year. The Federal Reserve’s (Fed’s) preferred inflation gauge, the Personal Consumption Expenditures Price Index, was slightly hotter in May with the 12-month increase rising slightly to 2.3%.

The subdued figures allayed fears—at least for now—that Trump’s tariffs would trigger a sharp rise in prices, despite businesses’ warnings about passing on costs and economists’ predictions that higher car and clothing prices would appear in May data. The substantial inventory build in the first quarter may have allowed businesses to delay passing through price increases as they await greater clarity on tariff policy. Over the summer, we expect a more complete picture to emerge as additional data on the impact of tariffs becomes available.

While many view Trump’s recent change to lower tariff policy as “backing down,” to us it seems much more likely that his goal was lower tariffs all along. We believe Trump’s negotiating style is to “go big,” with the goal of ultimately achieving higher—but more realistic—tariffs.

Adding Gold to our Priorities

The post–Liberation Day and tariff-induced market turbulence—as well as Moody’s Ratings’ downgrade of U.S. credit, citing concerns surrounding rising government debts and interest payment ratios—raised concerns that the country’s reputation has been harmed. Some speculate that investors will turn away from U.S. markets, particularly U.S. Treasuries, which could lead to a yield spike and exacerbate the deficit problem.

So far, there has been little evidence to substantiate this projection. Most of the recent Treasury auctions were strong, with some setting records for foreign demand. Additionally, 10-year Treasury yields have been mostly range bound for the last few years.

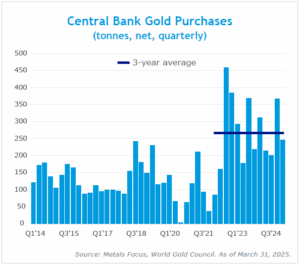

However, we recognize that foreign investors likely feel, at least to some degree, that they can’t rely as heavily on U.S. investments. In our view, this realization likely began in the aftermath of the Russian invasion of Ukraine, as the U.S. weaponized the dollar against Russia, leading many countries to reassess their reliance on the greenback and accelerate gold purchases.

We believe long-term risk to the U.S. dollar has increased, resulting from dollar weaponization, aggressive trade policy, and, to a lesser extent, concerns about the deficit. The dollar’s weakness in 2025 follows several years of being significantly overvalued. One benefit of a weaker dollar is the boost it provides to U.S. exports, as American goods become relatively more affordable to foreign buyers—an outcome aligned with the current administration’s goals.

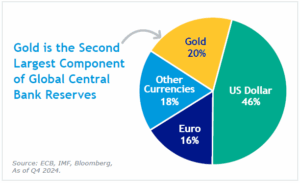

We believe some countries will reassess the reliability of the U.S. and consider shifting a portion of their reserves from the U.S. dollar and Treasuries to buy gold. Thus, after Liberation Day, we added a small gold allocation to some of our longer-term portfolios to help protect against geopolitical risk and reduce credit exposure. Gold appears expensive relative to traditional valuation metrics, such as interest rates, but we believe we may be in the early innings of a structural increase in gold demand from foreign nations. Indeed, at the end of 2024, gold surpassed the Euro as the world’s second-largest reserve asset.

U.S. dollar, bond markets not in crisis

Although we view the addition of gold as prudent, we do not believe that the U.S. dollar or bond market is on the verge of a crisis. We believe the dollar will remain the global reserve currency over the short to intermediate term, as there are no suitable replacements.

We also believe that interest rates won’t surge dramatically higher. The higher rates go, the greater the drag on inflation and growth, and the more attractive bonds become on an absolute basis. In this way, higher rates are the cure to higher rates. We believe policymakers—from the Treasury to the Fed and Congress—would likely all respond to higher rates if they became problematic for the economy.

After Liberation Day and the ensuing volatility in equity markets, U.S. Treasuries, long viewed as a haven during times of uncertainty, sold off. The bond market steadied after the tariff pause, while the S&P 500 rose nearly 10%, recording its largest one-day percentage gain since 2008.

Economic and Market Recap

The S&P 500 Index advanced in the second quarter of 2025, bouncing back from a first-quarter decline to register its seventh quarterly gain in the last two years. The U.S. stock gauge underperformed developed and emerging markets indexes.

Even though Trump’s early-April large-scale tariff announcement raised recessionary fears and weighed heavily on stocks, the U.S. market largely recovered in April after Trump eliminated some tariffs on electronic products, paused many “reciprocal” tariffs for 90 days, and indicated a willingness to engage in trade negotiations. In May and June, stocks broadly rallied amid reduced tariff tensions, as the U.S. and China came to a temporary trade agreement and negotiations with the EU progressed. Across the quarter, better-than-expected earnings reports and guidance from several companies further bolstered stocks.

U.S. GDP declined by 0.5% in the first quarter of 2025, according to the Commerce Department, the first contraction since the first quarter of 2022. Economists had expected 0.4% growth. The pace of consumer spending slowed, and federal government spending fell, amid cuts by DOGE. Imports surged as companies increased inventory ahead of tariff impacts, which weighed on GDP growth.

The Fed once again held the federal funds rate at a target range of 4.25% to 4.50% at its May and June meetings, after reducing the rate three times in late 2024. The Fed projected higher inflation and reduced its growth forecast, while comments from Fed Chair Jerome Powell suggested that the central bank wants to see how economic data evolves amid uncertainty around trade and geopolitical events, such as conflicts in the Middle East.

Commodities markets saw periods of heavy volatility and widely mixed returns across sectors, with broad commodity indexes falling sharply after Liberation Day, before climbing back to finish the quarter modestly higher. Oil prices, which declined to multiyear lows in April and early May, rose sharply after Israel began military strikes on Iran. However, a ceasefire agreement was reached, and crude oil finished the quarter below its pre-conflict price. Gold continued its lengthy rally, rising to finish near all-time highs.

Within our portfolios, we have maintained a preference for international stocks, which have benefited from enthusiasm around fiscal stimulus in Europe, governance reforms in Asia, and a weaker U.S. dollar. While we do not expect a recession in the U.S., we are closely watching the labor market, where we continue to see a pattern of strong initial job gains followed by downward revisions. This trend experienced a small but positive reversal in June, as prior job gains were revised higher for the first time since December. We will continue to monitor the demand for U.S. Treasuries and anticipate that the Fed will cut rates at least twice this year. Over the summer, we expect to gain greater clarity on the impact of tariffs and will continue to monitor inflation data closely.