Should Equity Investors Diversify Internationally?

June 3, 2019

Generally, investors understand that a portfolio’s risk is strongly related to its return potential. Diversification, however, is a notable exception to this rule, earning it the title of the only “free lunch” in investing. Academic research has firmly established the potential of diversification to reduce portfolio volatility without reducing expected returns.

Considering the highly volatile nature of stocks, it’s intuitive that concentrating in a single basket of stocks is risky. Overall portfolio volatility can be reduced by investing more broadly across stocks that are less related. Yet, despite essentially universal agreement on the benefits of diversification, many investors have very little exposure to international stocks.

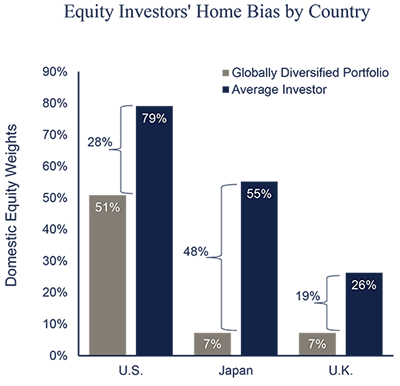

This bias for domestic stocks isn’t just a U.S. trait. Investors all over the world, regardless of which weighting scheme is used as a baseline, exhibit a strong preference for stocks in their home country. For example, investors who reside in the U.S., Japan, and the U.K. (the countries with the largest investable equity markets) overweight stocks of their own country by 28%, 48%, and 19%, respectively, compared with the allocation of a globally diversified benchmark such as the All Country World Index (ACWI), shown below.

Source: “The global case for strategic asset allocation and an examination of home bias,” Vanguard Research, February 2017.

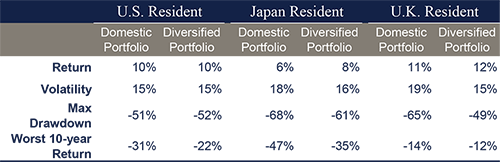

When we look at how that home bias has paid off over the long run, we find that investors in all three countries would have benefited from diversifying beyond their domestic stock market. To illustrate this, we conducted a simple study (see table below) that compared the returns that investors residing in the U.S., Japan, and the U.K. would have earned from domestic stocks with the returns of a naively diversified portfolio that equally weighted each country.

*All calculations are based on nominal returns from 12/31/1969 – 4/30/2019. Results are in Dollars, Yen and Pounds for U.S., Japan, and U.K. residents, respectively. Return and Volatility are annualized; Max Drawdown and Worst 10-year Return are cumulative.

Shown in the table above, investors living in Japan or the U.K. would have benefited most from diversifying outside their home country. In each case, the diversified portfolio was less risky (based on a variety of metrics) and had higher returns. Even investors residing in the U.S., which had the strongest performing domestic stock market, would have benefited from diversifying among worse performing countries.

When confronted with this data, it may seem inconceivable that anyone would concentrate in their home country, but diversification isn’t without tradeoffs. The primary drawback of global diversification is the risk of dramatically underperforming domestic benchmarks—sometimes for a prolonged period. Those in the U.S. with diversified portfolios have recently experienced this. Over the last year, the diversified portfolio from our study would have underperformed U.S. stocks by 12%. That’s significant, but also consider that over the last 10 years, the diversified portfolio would have trailed U.S. stocks by a cumulative 145%. After a period like the last decade, a portfolio of domestic stocks may seem a lot more appealing. Amazingly, this isn’t even close to the worst 10-year period of underperformance. During the 10 years from 1989 to 1998, the diversified portfolio would have underperformed U.S. stocks by 347%! Clearly, those who desire performance similar to a domestic benchmark could find diversification to be very frustrating, but the risk goes well beyond negative feelings. The greatest risk is that an investor abandons a diversified portfolio just before it turns around.

Considering the risk of underperformance, investors should carefully weigh the pros and cons of a globally diversified portfolio. Of course, the decision to diversify isn’t binary. Investors must decide not only if they should diversify, but how much.

At Blue Trust, we seek to understand clients’ priorities and to construct portfolios that will best accomplish those goals, whether that be to gain exposure to domestic markets, seek absolute return goals without consideration to domestic benchmarks, or something in between. To discuss the appropriate level of international diversification for your investment strategy, please contact a Blue Trust advisor by calling 800.987.2987 or emailing blog@bluetrust.com.

Be sure to visit our YouTube channel and follow us on LinkedIn!

Diversification may help reduce risk, but it does not eliminate risk. All investments involve risk and the possibility of loss. Past performance does not guarantee future results. 8578574-05-19

Leave a Reply

Want to join the discussion?Feel free to contribute!